SC PR-26 2022-2026 free printable template

Show details

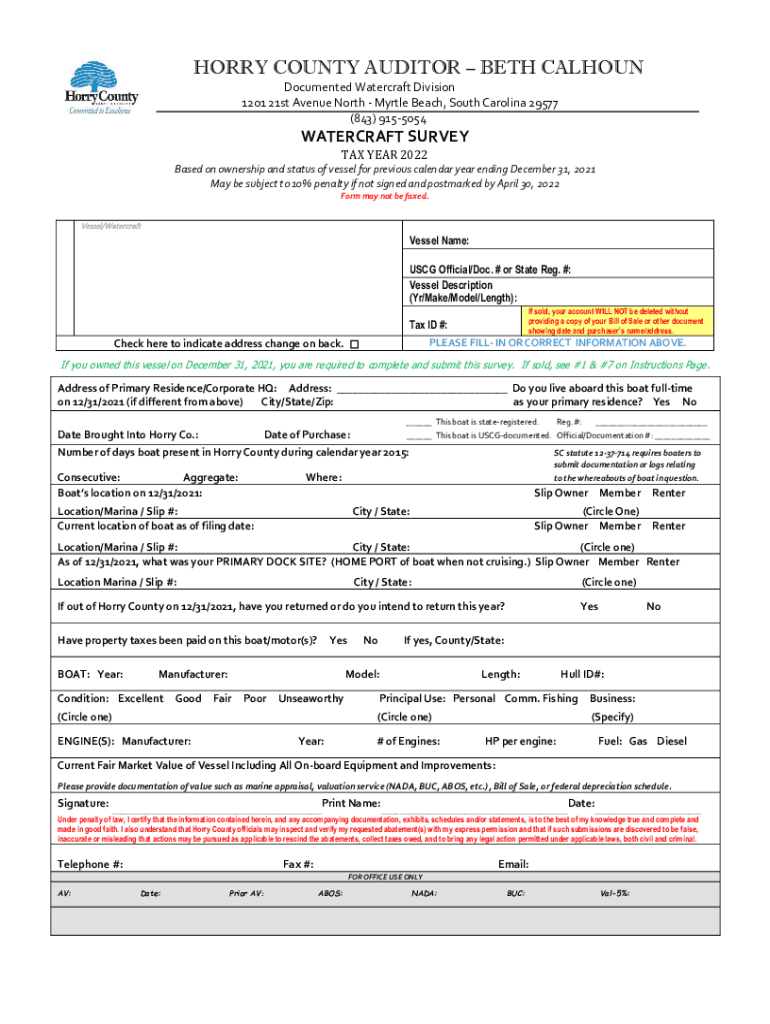

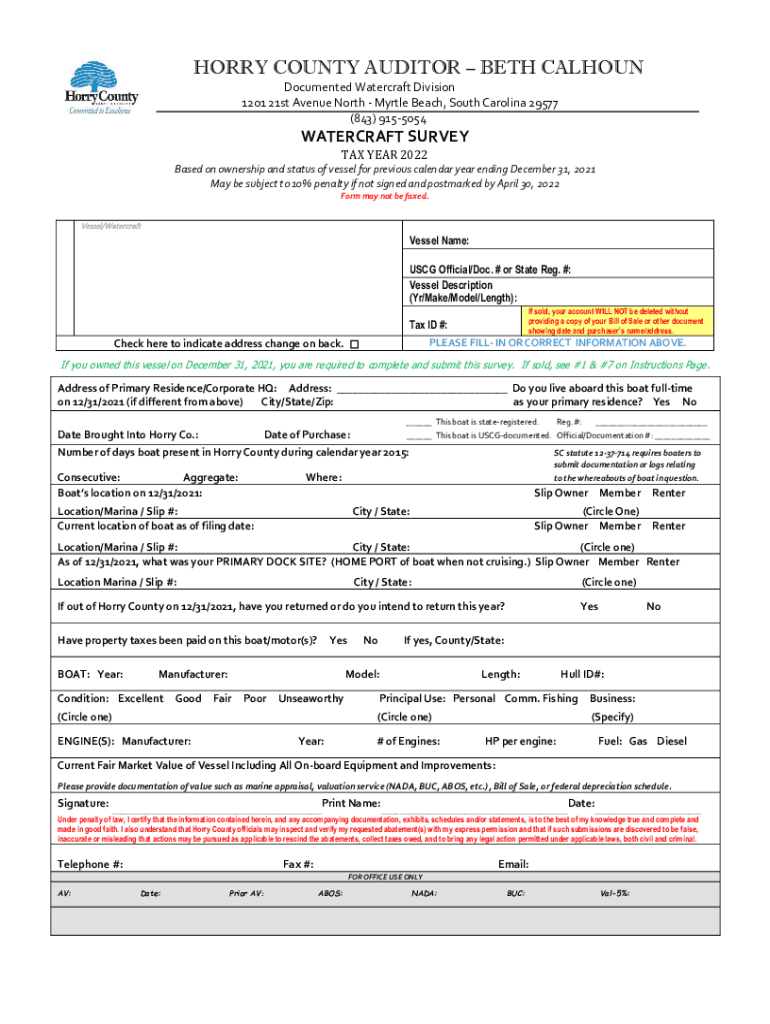

HORRY COUNTY AUDITOR BETH CALHOUN Documented Watercraft Division 1201 21st Avenue North - Myrtle Beach South Carolina 29577 843 915-5054 WATERCRAFT SURVEY TAX YEAR 2022 Based on ownership and status of vessel for previous calendar year ending December 31 2021 May be subject to 10 penalty if not signed and postmarked by April 30 2022 Form may not be faxed. Vessel/Watercraft Vessel Name USCG Official/Doc. or State Reg. Vessel Description Yr/Make/Model/Length If sold your account WILL NOT be...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign horry county homestead exemption form

Edit your pdffiller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your horry tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing horry county personal property return online online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit homestead exemption horry county sc form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC PR-26 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out horry county personal property tax form

How to fill out SC PR-26

01

Obtain a copy of the SC PR-26 form from the official website or the relevant office.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide the details of the property for which you are applying.

04

Indicate the specific purpose of the application clearly.

05

Fill out any required financial information or supporting documentation as specified.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the completed form to the appropriate office or authority as instructed.

Who needs SC PR-26?

01

Individuals applying for property-related permits or registrations.

02

Landowners seeking to make official modifications to property records.

03

Real estate professionals assisting clients with property submissions.

04

Anyone involved in legal processes regarding property transactions.

Fill

homestead exemption horry county

: Try Risk Free

People Also Ask about form 14817

How to calculate Horry County South Carolina property tax?

Primary Residence Purchase Price. x 4% = Assessed Value. x .1367. = TAXES DUE. Purchase Price. x 6% = Assessed Value. x .2520. = TAXES DUE.

When can I apply for homestead exemption in SC?

Apply between July 16th and before the first penalty date of the tax year that the exemption can first be claimed. If you apply during the post-application period and you qualify, you may be eligible for a refund for the preceding year. Where do I apply?

Is every Horry County resident required to complete pt100 form?

Personal Property PT-100 If you owned a property in Horry County on December 31st of the prior year and this was not your legal residence, you are required to complete and submit a Personal Property Return.

What is the SC PT100 form for?

Business Personal Property Return (PT100)

Who has to file SC PT 100?

Businesses that have a retail license must file a form PT-100 to the Department of Revenue. This form is available on the Department of Revenue website. Businesses that manufacture a finished good must file a PT300 to the Department of Revenue.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit horry county sc real estate tax records in Chrome?

horry county pt 100 instructions can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I sign the homestead exemption south carolina electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your sc pt100 instructions in seconds.

How can I edit personal property tax horry county on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing horry county pt 100.

What is SC PR-26?

SC PR-26 is a form used in South Carolina to report tax-related information, specifically regarding certain types of income and withholding.

Who is required to file SC PR-26?

Employers and entities that withhold South Carolina income tax from wages or other payments are required to file SC PR-26.

How to fill out SC PR-26?

To fill out SC PR-26, you need to provide details such as the employer's identification information, periods of payment, amounts withheld, and employee details, ensuring accuracy in figures reported.

What is the purpose of SC PR-26?

The purpose of SC PR-26 is to ensure compliance with state tax withholding regulations and to provide the state with a record of withheld taxes, enabling proper tax collection and reporting.

What information must be reported on SC PR-26?

SC PR-26 must report information including the employer's name and identification number, employee names and Social Security numbers, total wages paid, total South Carolina income tax withheld, and the reporting period.

Fill out your SC PR-26 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Horry County Building Permits Issued Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to horry county code enforcement forms

Related to horry county property records

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.